Discover the Best 10-Year Term Life Insurance Plans with Denesha

Secure your family’s future with a term length tailored to your needs, ranging from 10 to 30 years.

A Smart Strategy to Save on Life Insurance

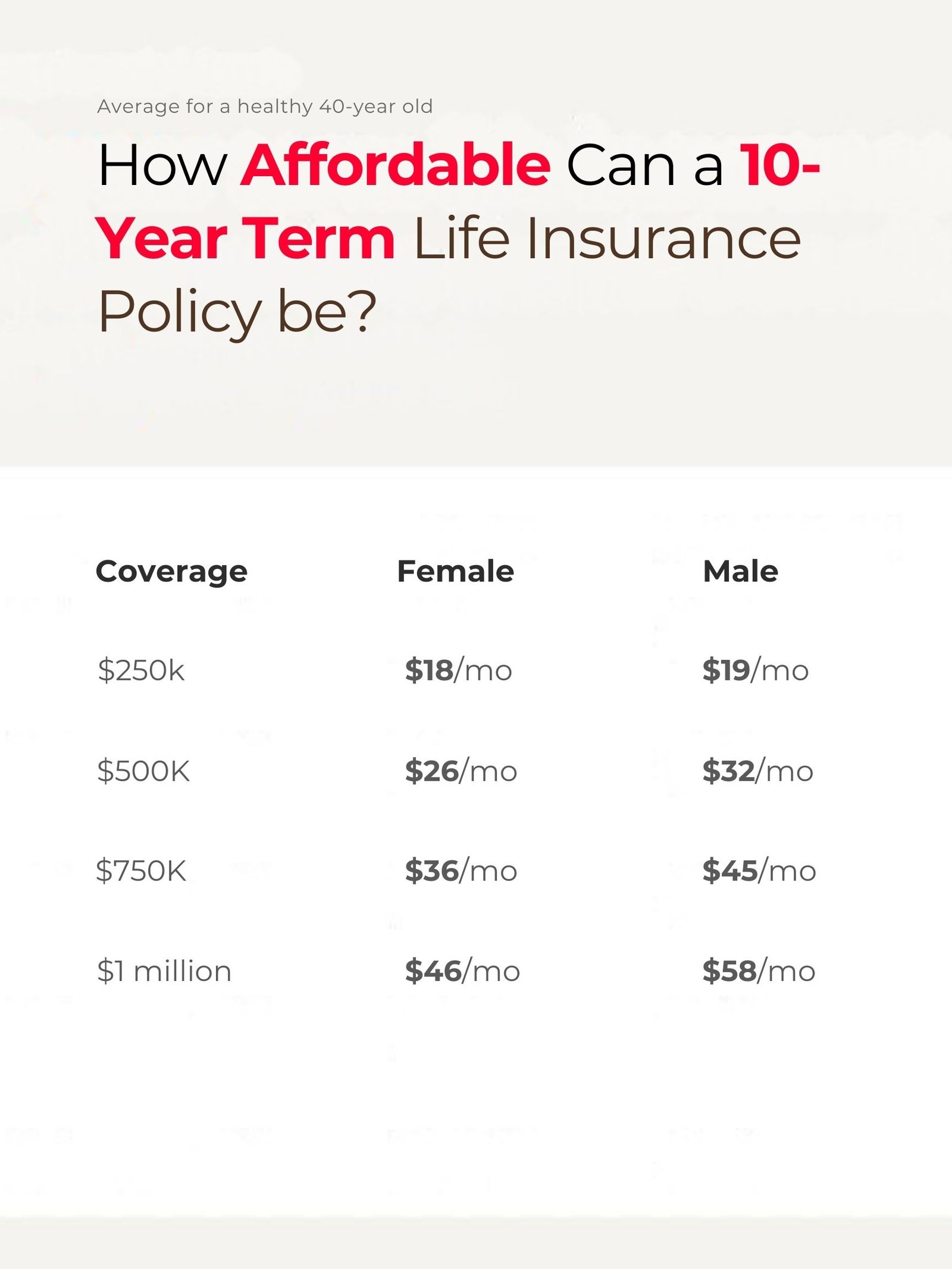

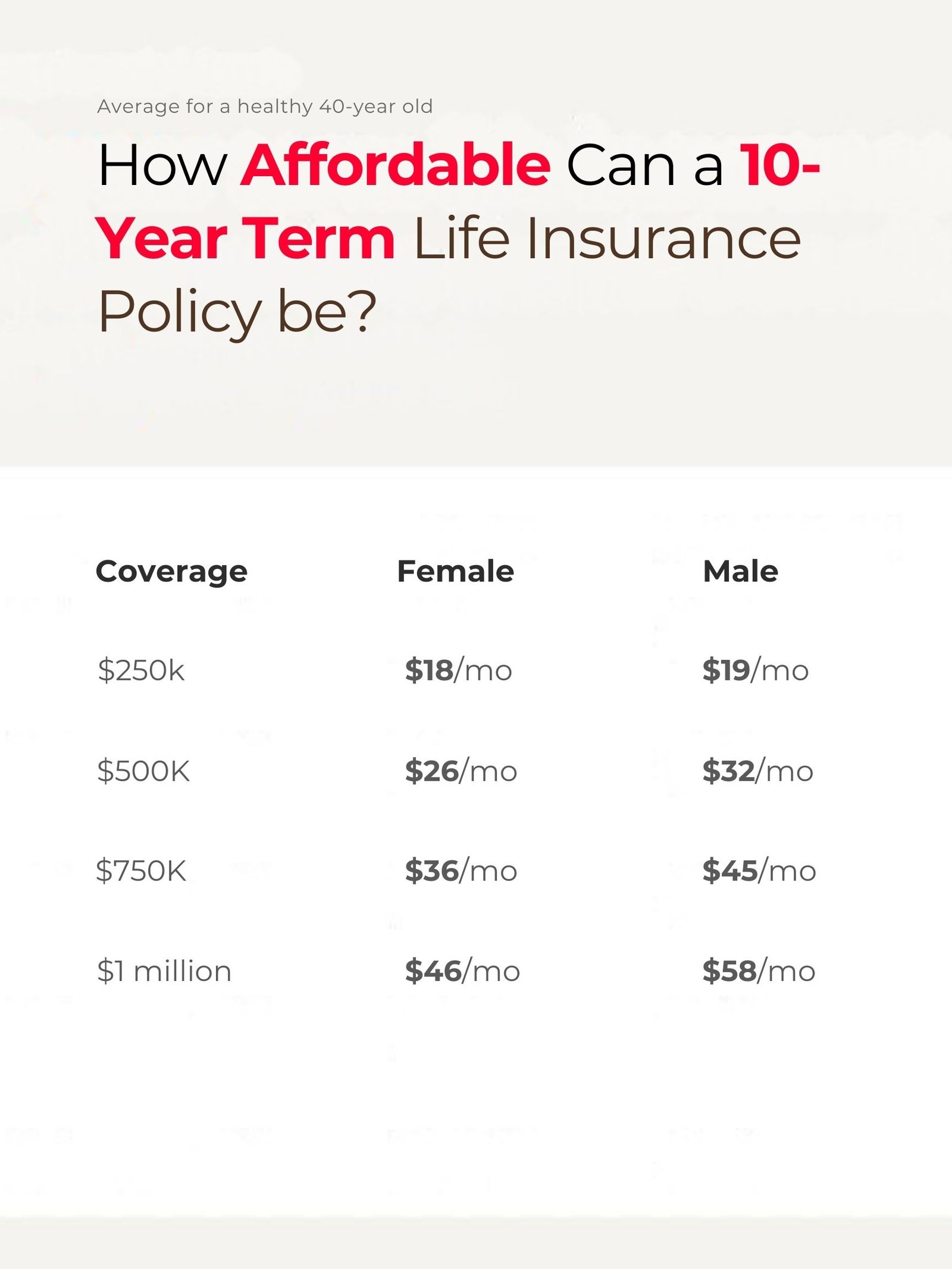

Investing in a 10-Year Term: What It Might Cost You

Sample monthly premiums for a fit 40-year-old individual, both male and female. From $20K to $1.5M in coverage, Denesha offers versatile life insurance options at competitive rates. A 10-year insurance policy for $500,000 might start as low as $16 a month, varying based on health, age, and more.

The Power of Life Insurance: Protect Those Who Matter Most

Imagine the peace of mind you will have knowing that your family’s future is all covered if something unexpected happens. Life insurance takes care of burdens like funeral expenses, outstanding loans, home installments, academic fees, and daily needs.

Begin your journey towards a secure future with a hassle-free online insurance quote. With just a few clicks and health-related answers, you’re steps away from a no-medical-exam life insurance. A quick, efficient way to shield your dearest.

Deciphering Your Ideal Coverage: One Size Doesn’t Fit All

Contemplating a $1 million life insurance policy? While it provides a robust safety net, it’s vital to gauge if it aligns with your unique needs. Aim for a coverage that’s tenfold your yearly earnings.

The DIME method (debt, income, mortgage, education) can aid in tailoring your coverage selection.

- Debt: Your remaining financial obligations, e.g., educational loans or card dues.

- Income: Projected years of family support multiplied by your wage ($100K wage x 10 years = $1 million).

- Mortgage: Home debt or housing costs.

- Education: Future educational expenses for your offspring.

Eligibility for a $1 million Denesha Life Insurance Policy

- Age: Insurance rates generally rise with age. Youth equals more potential coverage.

- Health: A healthier lifestyle improves your chances for an elevated policy.

- Income: Most applicants are eligible for policies up to 30x their annual income. Evaluate your income and fiscal standing to determine your ideal coverage.

Embracing a Million-Dollar Coverage with Denesha

Quick Online Quotes

Denesha ensures a speedy and simplified application process. Finish our digital application swiftly. No paperwork, no calls—although we’re here if you need assistance. Our office hours are 9:00 Am to 5:30 Pm Monday to Friday. When you call us, there will be real experts ready to assist you – no automated responses.

Tailored, Cost-Effective Coverage

Diverse coverage options to resonate with your needs and finances.

Genuine Counsel, Zero Pressure

Choose when and if you’d like to connect with our expert consultants. We’re here to guide, never to pressure.

Dive into Denesha’s World – Get Your Personalized Quote Now

Explore projected rates for a comprehensive $500K life insurance protection. While individual circumstances vary, some standards can guide your choice. A $500K life insurance safeguards your loved ones, but is it sufficient?

Do you have the NEW life insurance?

Most people don’t know that there is a new life insurance where you don’t have to die to receive benefits. I can facilitate this for you!

What are the types of Life Insurance?

- What It Is: A policy that provides coverage for a set period, typically 10, 20, or 30 years.

- Who It’s For: Ideal for people who need significant coverage for specific financial commitments that will diminish over time, such as a mortgage or children’s education costs.

- What It Is: These policies provide lifelong coverage and feature an investment component where cash value accumulates.

- Who It’s For: Best suited for those seeking both lifelong protection and a means to accumulate tax-deferred savings.

- What It Is: Whole Life insurance is a type of permanent life insurance that offers guaranteed lifetime coverage, provided premiums are paid. One of the defining features is its cash value component, which grows at a guaranteed rate.

Who It’s For: This policy is particularly suited for those who desire a fixed premium and guaranteed growth of cash value. It’s a good fit if you’re looking for both a long-term financial safety net and a potential source of loans or cash withdrawals.

- What It Is: Universal Life insurance is another form of permanent life insurance, but it offers more flexibility than Whole Life insurance. You can adjust your premium payments and death benefits to some extent. It also has a cash value component, but the growth is tied to current interest rates or investment performance.

Who It’s For: This policy is ideal for those who want lifetime coverage but also desire some level of flexibility to adjust premiums and death benefits according to their changing financial situation.

- What It Is: Similar to universal life insurance but with the cash value portion earning interest based on the performance of a market index.

- Who It’s For: Suitable for those who want the potential for higher returns without the risks of direct investment in the market.

- What It Is: A permanent life insurance policy with an investment component that allows you to invest your cash value in various sub-accounts.

- Who It’s For: Those who are financially savvy and want to integrate their life insurance with an investment opportunity.

- What It Is: This is a more specialized, smaller coverage policy designed to cover funeral costs and other end-of-life expenses.

- Who It’s For: Generally targeted at seniors who wish to ensure that their families are not burdened with their end-of-life expenses.