Denesha Insurance Agency Medicare

Welcome to the medicare page! Here you will find some valuable information on what medicare plans are available and how to select the right plan that fits your needs.

Meet Debbie Denesha

Selecting a Medicare Plan can feel overwhelming.

Guiding you through this process to help you determine the right plan for you is my goal. Whether you are new to medicare (turning 65) or needing to review your annual options, you can call me to schedule an informational meeting.

During this meeting I will explain the parts of medicare and your options.

I am an independent agent who works for you and not an insurance company. As a broker, I am here to help you understand all of your choices which allows you to choose the plan best suited to your needs and budget.

Medicare Explained: What is it?

Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

The different parts of Medicare help cover specific services:

Medicare Part A (Hospital Insurance) If you are over the age of 65 and have paid money into social security for at least 10 years, you are automatically enrolled into the federal government’s Medicare Part A insurance plan at no cost to you. Sometimes referred to as hospital insurance, Medicare Part A is designed to help pay for inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Even if you are not eligible for free coverage, you can still apply for Medicare Part A! You just have to sign up and pay a monthly premium.

Medicare Part B (Medical Insurance) Part B covers certain doctors’ services, outpatient care, home health care, durable medical equipment and preventive services (like screenings, shots, and yearly “wellness visits”). Also covered are more specialized services like diabetes testing and care, cancer screenings, mammograms, lab tests, flu shots, and x-rays. Like with Part A, you are typically automatically enrolled in Medicare Part B if you are receiving retirement benefits before age 65 or qualify for Medicare through disability. Medicare Part B doesn’t come free, but paying the premiums is easy because the cost is automatically pulled from your Social Security check each month.

Medicare Part D (Prescription Drug Coverage) Part D adds prescription drug coverage to your existing insurance plan, including Original Medicare, some Medicare Cost Plans, some Medicare Private-Fee-for-Service Plans and Medicare Medical Savings Account Plans. What drugs are covered by your Part D depends on the type of drug. The drugs are organized in a list called a formulary, which contains tiers. You can generally expect to pay more for a drug listed in the higher tier than a drug listed in the lower tier, though you or your prescriber can ask your plan for an exception in some instances. Prescription drugs can cost a fortune, so it is important to have a coverage plan no matter what Medicare service you are using.

Supplemental Coverage Original Medicare pays for much – but not all – of the cost for covered health care services and supplies. Medicare Supplement Insurance policies, sold by private companies, can help pay some of the remaining health care costs for covered services and supplies, like copayments, coinsurance, and deductibles. They also offer coverage that Original Medicare doesn’t have, like medical care when you travel outside of the United States. They do not, however, cover long-term care, vision or dental care, hearing aids, eyeglasses, or private-duty nursing. You must have Original Medicare (Part A and Part B) in order to qualify for Medicare Supplement Insurance. These policies are also called Medigap.

From The Blog

What are your Medicare Options?

There are 2 ways to get Medicare:

Option One

Original Medicare

- Original Medicare includes Medicare Part A (Hospital Insurance) and Part B (Medical Insurance)

- If you want drug coverage, you can join a separate Part D plan.

- To help pay your out-of-pocket costs in Original Medicare (like your deductible and 20% coinsurance), you can also shop for and buy supplemental coverage.

Option Two

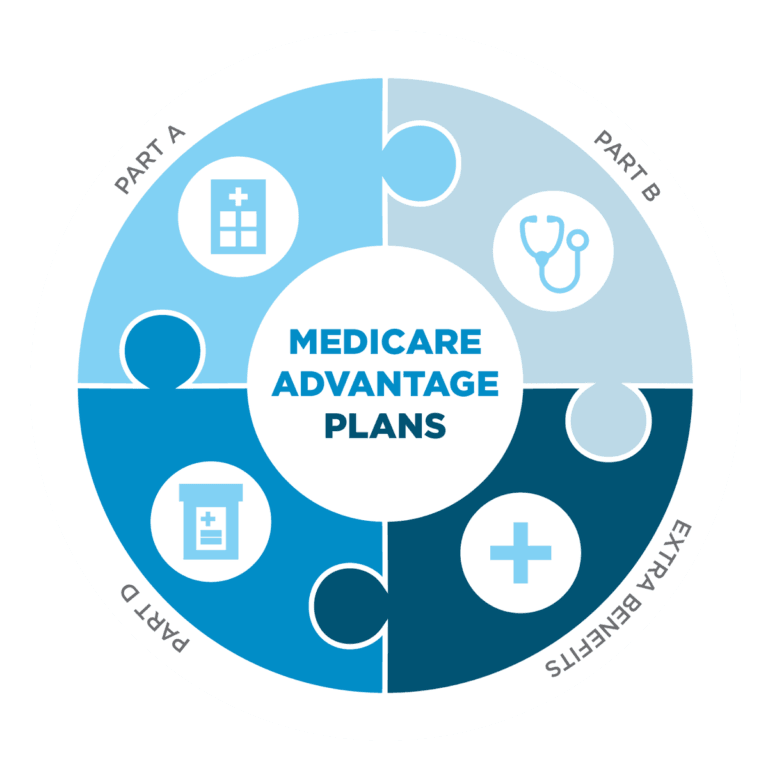

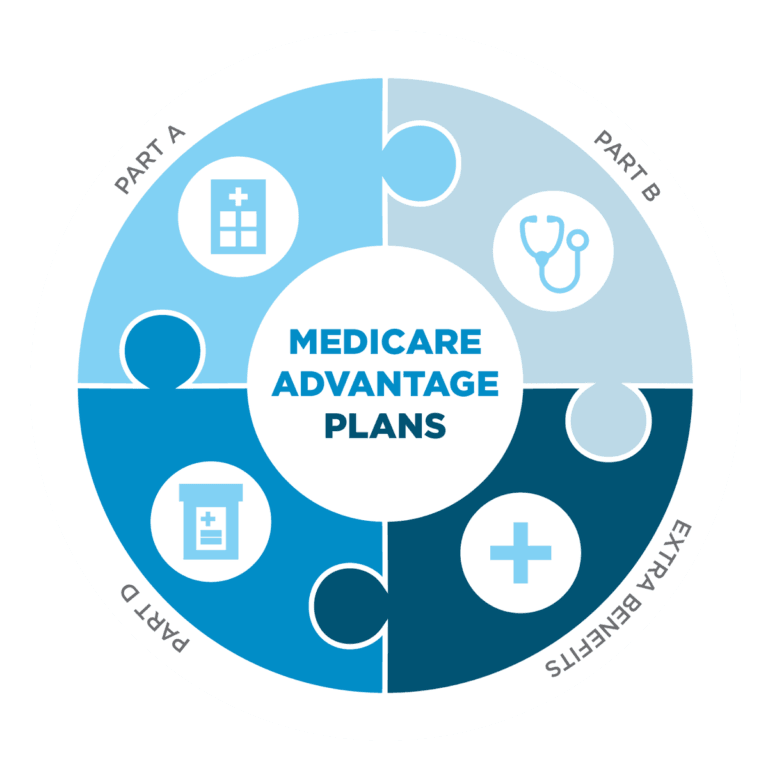

Medicare Advantage (also known as Part C)

- Medicare Advantage is an “all in one” alternative to Original Medicare. These “bundled” plans include Part A, Part B, and usually Part D.

- Some plans may have lower out-of-pocket costs than Original Medicare

- Some plans offer extra benefits that Original Medicare doesn’t cover— like vision, hearing, or dental.