Top 5 Myths About Life Insurance Debunked

Life insurance is a crucial part of financial planning, yet it’s often misunderstood due to common myths and misconceptions. These misunderstandings can prevent individuals from securing the protection they need. Here are the top five myths about life insurance, debunked to provide clarity and help you make informed decisions.

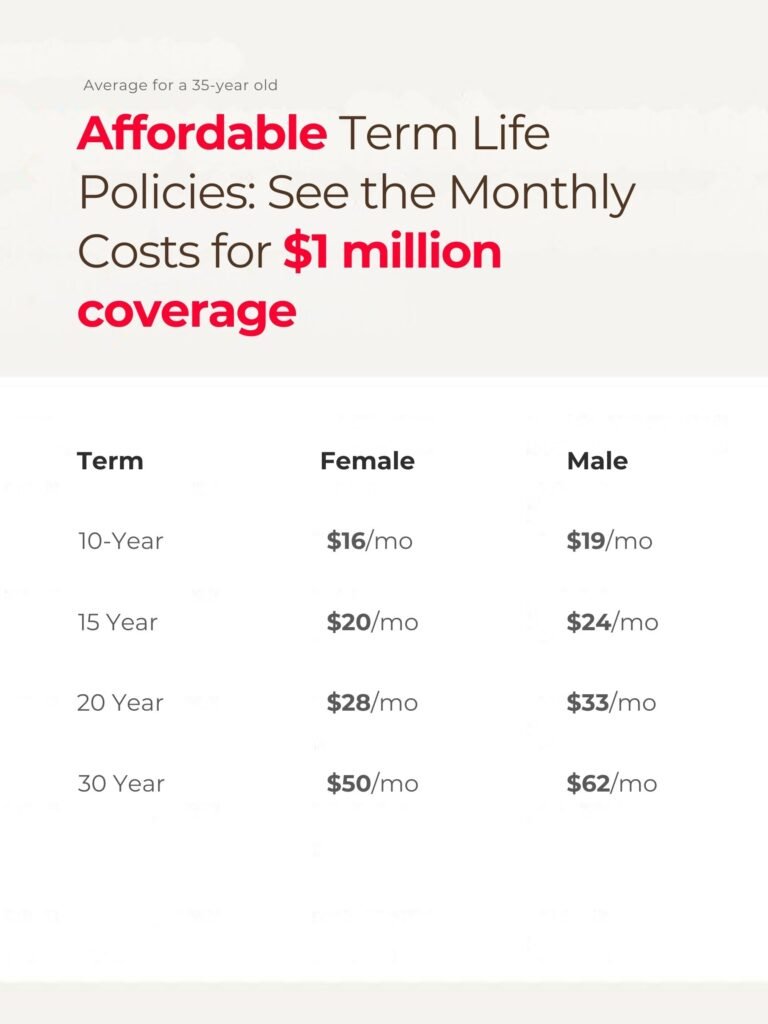

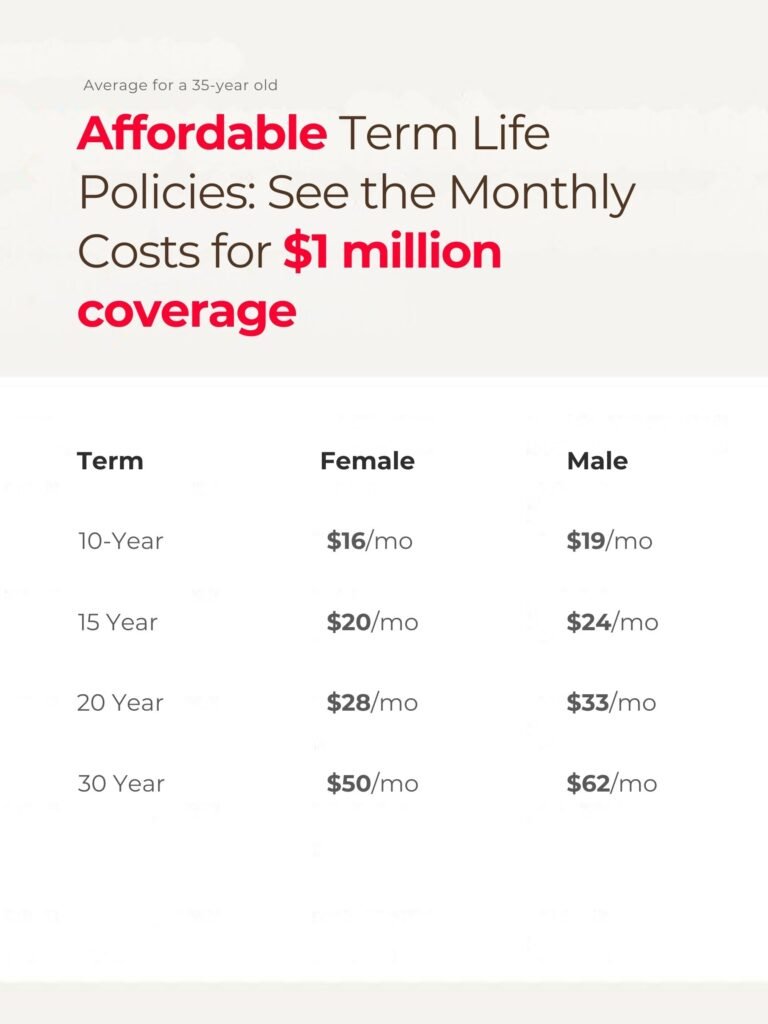

Myth 1: Life Insurance is Too Expensive

Many people believe that life insurance is prohibitively expensive, but this is often not the case. In fact, studies show that half of consumers overestimate the cost of life insurance, sometimes by as much as three times the actual cost. Term life insurance, for example, is generally very affordable, especially for younger and healthier individuals. There are also a variety of policy options available that can fit different budgets and needs. If you would like to explore life insurance costs more or get a quote and apply online by yourself or let us help you, check it out here.

Myth 2: Young and Healthy People Don’t Need Life Insurance

It’s a common misconception that life insurance is only necessary for older individuals or those with health issues. However, securing life insurance while you’re young and healthy is not only cheaper, but it also guarantees coverage before any potential health issues arise. Unexpected accidents or illnesses can occur at any age, making life insurance a prudent investment for anyone, regardless of their current health status.

Myth 3: Life Insurance Through an Employer is Enough

Relying solely on employer-provided life insurance can be risky. While it may provide some coverage, it often falls short of meeting long-term needs, especially if you change jobs or retire. Employer-provided policies are usually not portable, meaning your coverage ends when your employment does. To ensure comprehensive protection, it’s advisable to supplement employer coverage with an individual policy that you can tailor to your specific needs.

Myth 4: People with Pre-Existing Conditions Can’t Get Life Insurance

While it’s true that pre-existing conditions can make securing life insurance more challenging, it’s not impossible. Many insurance companies offer policies specifically designed for individuals with health issues, although premiums might be higher. Some options, like guaranteed issue life insurance, don’t require a medical exam, providing coverage even for those with serious health conditions.

Myth 5: Stay-at-Home Parents Don’t Need Life Insurance

The value of the work done by stay-at-home parents is often underestimated. Even though they may not earn an income, the cost of replacing the services they provide—such as childcare, housekeeping, and more—can be substantial. Life insurance for stay-at-home parents ensures that these costs are covered in the event of their untimely death, helping the family maintain their standard of living.

Conclusion

Understanding the realities of life insurance can help you make better decisions for your financial future. Don’t let these myths prevent you from securing the protection your family needs.